An asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. For the purposes of this discussion, we will assume that the asset being disposed of is a fixed asset. The disposal of long term assets should be carried out in a careful and controlled manner to ensure that the business realizes the best possible return on its investment. Furthermore once the sale of the fixed assets has been completed, the business must account for the proceeds from the sale in its financial statements.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Let’s consider the following example to analyze the different situations that require an asset disposal. Management should put in place essential controls to prevent any fraud risks with asset disposal.

Gain on Disposal of a Fixed Asset

As can be seen the gain of 1,500 is a credit to the fixed assets disposals account in the income statement. To do it, $75,000 cash will be debited, the equipment account of $100,000 will be credited, the accumulated depreciation of $50,000 will be debited, and a gain on disposition of $25,000 will be credited. The journal entries will be reflected in the period in which the agreement was made. When a fixed asset is no longer used it must be removed from the balance sheet. The removal will often result in a gain or loss to be recognized on the income statement. If the journal entries are incorrect, it may affect the accuracy of the balance sheet and income statement.

- Accordingly the net book value formula calculates the NBV of the fixed assets as follows.

- If the carrying amount of a fixed asset at the date of disposal is equal to the sale proceeds from disposal, there is neither gain nor loss.

- Let’s consider the following example to analyze the different situations that require an asset disposal.

- The company estimated its salvage value to be $0.2 million at the end of useful life of 5 years.

- To do it, $75,000 cash will be debited, the equipment account of $100,000 will be credited, the accumulated depreciation of $50,000 will be debited, and a gain on disposition of $25,000 will be credited.

- The net effect of this entry is to eliminate the machine from the accounting records, while recording a gain and the receipt of cash.

For cash purchases, the proceeds are debited to the Cash account. For businesses selling an asset by accepting a note from the buyer, the amount promised is debited to the Notes Receivable account. There are four accounts affected when writing off a fixed asset at disposal. When you write something off the books, accounts with normal debit balances are credited and accounts with normal credit balances are debited.

Supercharge your skills with Premium Templates

Motors Inc. estimated the machinery’s useful life to be three years. At the end of the third year, the machinery is fully depreciated, and the asset must be disposed of. The first step in recording a loan from a company officer or owner is to set up a liability account for the loan. Assets are resources that companies own that have economic value. Current (or short-term) assets are assets expected to be turned into cash in one year or less, while fixed (or long-term) assets are assets that companies expect to hold on to for long periods of time.

In this case, we recognize the entire book value of the asset as a loss of $15,000. CFI’s Course Accounting Fundamentals shows you how to construct the three fundamental financial statements. For example, a production tool is purchased for $10,000 and must participate in the activity of the company for a period of 10 years. Each year, the company then passes a depreciation allowance of $1,000. After five years, the net book value of the tool is $5,000, i.e. $ 10,000 – (5 x $1,000).

The result of these journal entries appears in the income statement, and impacts the reported amount of profit or loss for the period in which the transaction is recorded. Company B is also selling its machine for $50,000, except they have not had it as long. In their books, they would record the $100,000 cost as a credit. They would then debit the $30,000 as accumulated depreciation and the $50,000 as cash.

Disposal of an Asset with Zero Book Value and Salvage Value

If there is a difference between disposal proceeds and carrying value, a disposal gain or loss occurs. The fixed assets’ disposal is defined as the removal of a fixed asset from the assets of a company. The disposal of a fixed asset is an extraordinary transaction, that is to say an unusual one. Gains happen when you dispose the fixed asset at a price higher than its book value. In the real world, selling old, fixed assets at a gain is rare but we showed you an example of a gain for illustrative purposes. With disposition of assets accounting, a company may report a gain on sale, loss on sale or no proceeds when taking an asset off the books.

- When you write something off the books, accounts with normal debit balances are credited and accounts with normal credit balances are debited.

- To illustrate the journal entries, let’s assume that we have a fixed asset with an original cost of $50,000 and accumulated depreciation of $30,000 as of the beginning of the year.

- On July 1, Good Deal sells the equipment for $900 in cash and reports the resulting $180 loss on sale of equipment on its income statement.

- It is because both the cash proceeds and carrying amount are zero.

When an asset reaches the end of its useful life and is fully depreciated, asset disposal occurs by means of a single entry in the general journal. The accumulated depreciation account is debited, and the relevant asset account is credited. In other words, if the difference between the sale price and the net How to record the disposal of assets book value of the fixed asset disposal is positive, the company has obtained an asset gain. If the market value of the fixed asset is equal to or less than its book value, it is always possible to limit the loss as much as possible. To illustrate, assume a company sells one of its delivery trucks for $3,000.

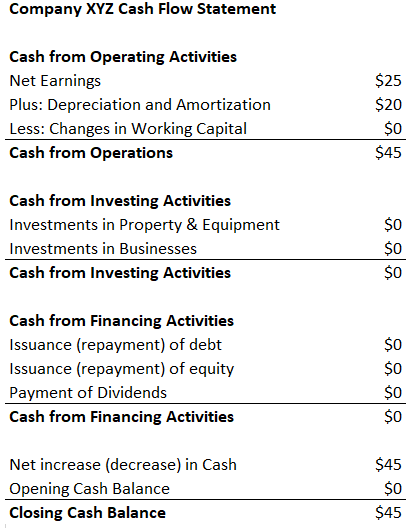

Cash Flow Statement

On July 1, Matt decides that his company no longer needs its office equipment. Good Deal used the equipment for one month (June 1 through June 30) and had recorded one month’s depreciation of $20. This means the book value of the equipment is $1,080 (the original cost of $1,100 less the $20 of accumulated depreciation).

A fixed asset disposal journal entry depends on whether the disposal was a sale, retirement, or exchange. The common denominator for all journal entries would be the recognition of a gain or loss. If you have a small business accounting software like QuickBooks Online, you can create disposal journal entries in QuickBooks Online’s journal module. The disposal of assets involves eliminating assets from the accounting records. This is needed to completely remove all traces of an asset from the balance sheet (known as derecognition).

In a way, this is the remaining value of the asset concerned at a time T. Company C’s machinery has depreciated $10,000 annually for the past 10 years. At this point, the machine has depreciated fully and Company C has decided to dispose of it and not try to sell it. They would mark the $100,000 as a credit for the cost of the asset. There are times when a business no longer has use for an asset and must get rid of it by either selling it, retiring it or simply disposing of it.

When a company disposes of an asset, that asset must also be removed from the company’s financial books. Since the cash proceeds ($1.5 million) are less than the carrying amount (i.e. $2.6 million), the disposal has resulted in a loss of $1.1 million ($2.6 million – $1.5 million). A company may need to de-recognize a fixed asset either upon sale of the asset to another party or when the asset is no longer operational and is disposed of. Companies acquire, dispose of, or exchange assets, or items of value that it owns. Operational assets are assets that the company uses to earn revenue, the money it earns from selling its goods and services, and are not sold to customers. As can be seen the ‘profit’ on disposal is negative indicating that the business actually made a loss on disposal of the asset.

Since the asset had a net book value of 3,000 the profit on disposal is calculated as follows. In the second part of the question the business sells the asset for 2,000. Motors Inc. owns a machinery asset on its balance sheet worth $3,000.

When companies decide to discard their assets through an exchange or sale, it is referred to as a disposition. It may also occur when companies need to end the life of damaged or stolen assets involuntarily. However, regardless of the method of disposition, the accounts related to the discarded assets should be removed from the company records. The Accumulated Depreciation account contains all the life-to-date depreciation of an asset and appears on the balance sheet as an offset to the Fixed Assets account. When an asset is disposed of, all of the assets’ accumulated depreciation must be removed from the Accumulated Depreciation account with a debit entry. When there are no proceeds from the sale of a fixed asset and the asset is fully depreciated, debit all accumulated depreciation and credit the fixed asset.

Generally this involves reducing the value of the fixed asset on the balance sheet and recognizing any gain or loss on the income statement. The overall concept for the accounting for asset disposals is to reverse both the recorded cost of the fixed asset and the corresponding amount of accumulated depreciation. Any remaining difference between the two is recognized as either a gain or a loss. The gain or loss is calculated as the net disposal proceeds, minus the asset’s carrying value.

As the carrying amount exceeds the disposal proceeds, a loss of $3,000 occurs on disposal. On the disposal of an asset with zero net book value and zero salvage value, no gain or loss is recognized because both the cash proceeds and carrying amounts are zero. To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.

Eric Gerard Ruiz is an accounting and bookkeeping expert for Fit Small Business. He completed a Bachelor of Science degree in Accountancy at Silliman University in Dumaguete City, Philippines. Before joining FSB, Eric has worked as a freelance content writer with various digital marketing agencies in Australia, the United States, and the Philippines.

The truck is in the accounting records at its original cost of $20,000. Combining the $20,000 and the $18,000 results in a book value (or carrying value) of $2,000. To deal with the asset disposal we first need to calculate its net book value (NBV) in the accounting records. Accordingly the net book value formula calculates the NBV of the fixed assets as follows. Any loss on disposal of a fixed asset is added back to net income in preparation of the cash flows from operating activities section of statement of cash flows under the indirect method.

Bintulu Port, VS Industry, Puncak Niaga, Sunway REIT, Magnum … – The Edge Malaysia

Bintulu Port, VS Industry, Puncak Niaga, Sunway REIT, Magnum ….

Posted: Thu, 17 Aug 2023 16:48:13 GMT [source]

It must appear as such in the income statement of the balance sheet. The business receives cash of 2,000 for the asset, however it still makes a loss on disposal of 1,000 which is an expense in the income statement. If there are any proceeds from the sale, you should record them accordingly.